Bank of Canada rate hike

Bank of England chief warns of fresh interest rate hike. All eyes will be on the Bank of Canadas interest rate decision this week which some say could be its last increase of the year and perhaps of this rate cycle.

Bank Of Canada Hikes Interest Rates Another 50 Bps And Isn T Done Yet

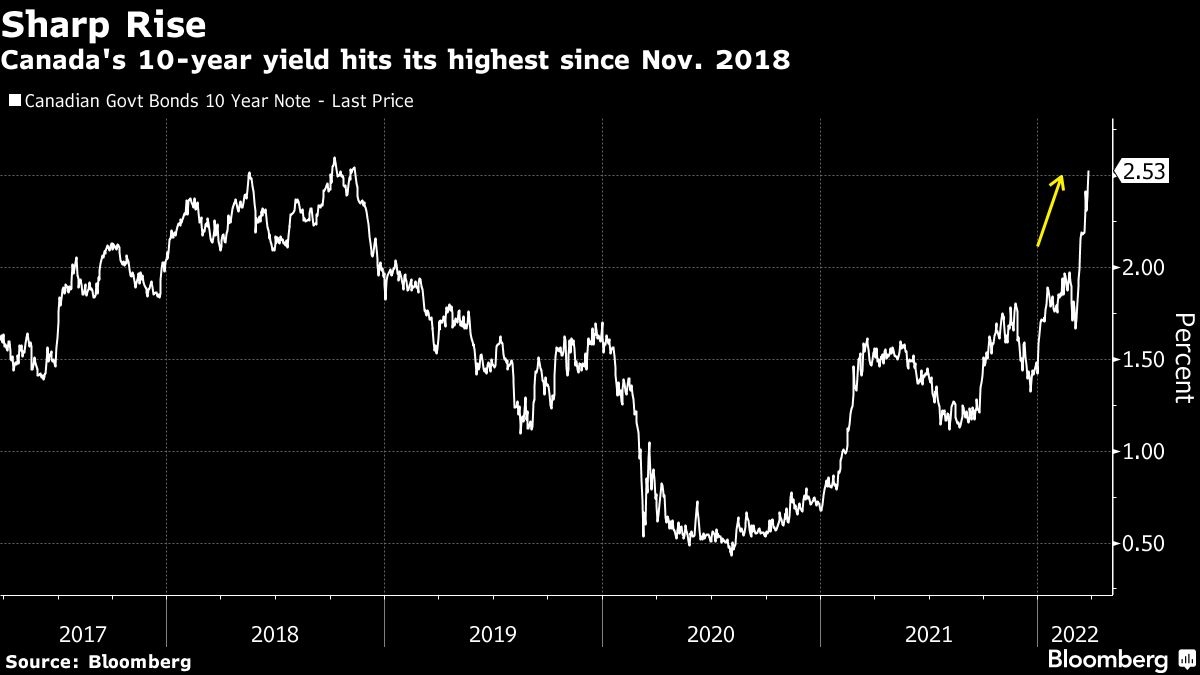

The central bank has lifted rates by 300 basis points in just six months as it looks to wrangle inflation back to the 2 target.

. When will the rate-hike cycle end. Two individuals look at a popular trend for Atlantic Canada storm chips in the Dominion grocery store before the arrival of Hurricane Fiona in Corner Brook Newfoundland Canada September 23. The highest rate hike.

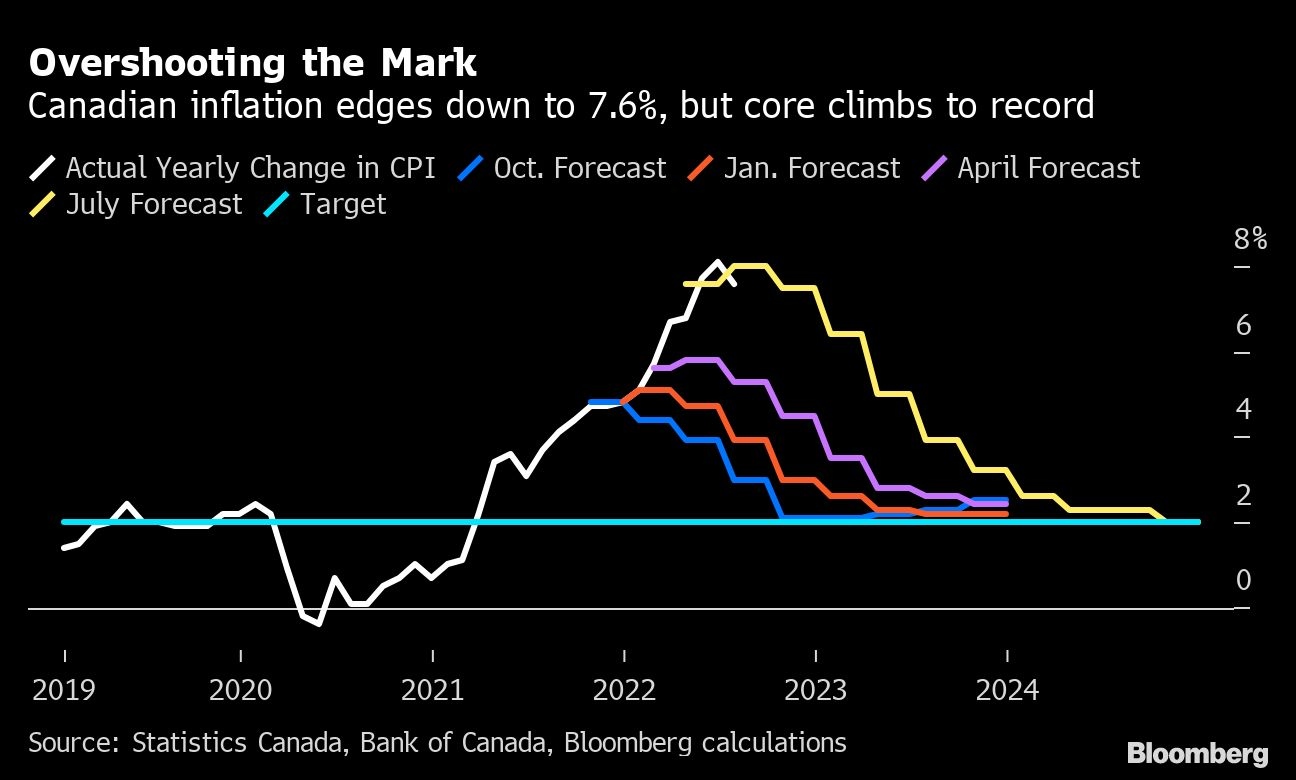

Bank of Canadas Carolyn Rogers says inflation wont come down overnight. Bank of Canada raises key interest rate to 325 per cent signals further hike Sep 7 2022 Leave a. Canadas inflation rate edged down to 70 in August from 81 in.

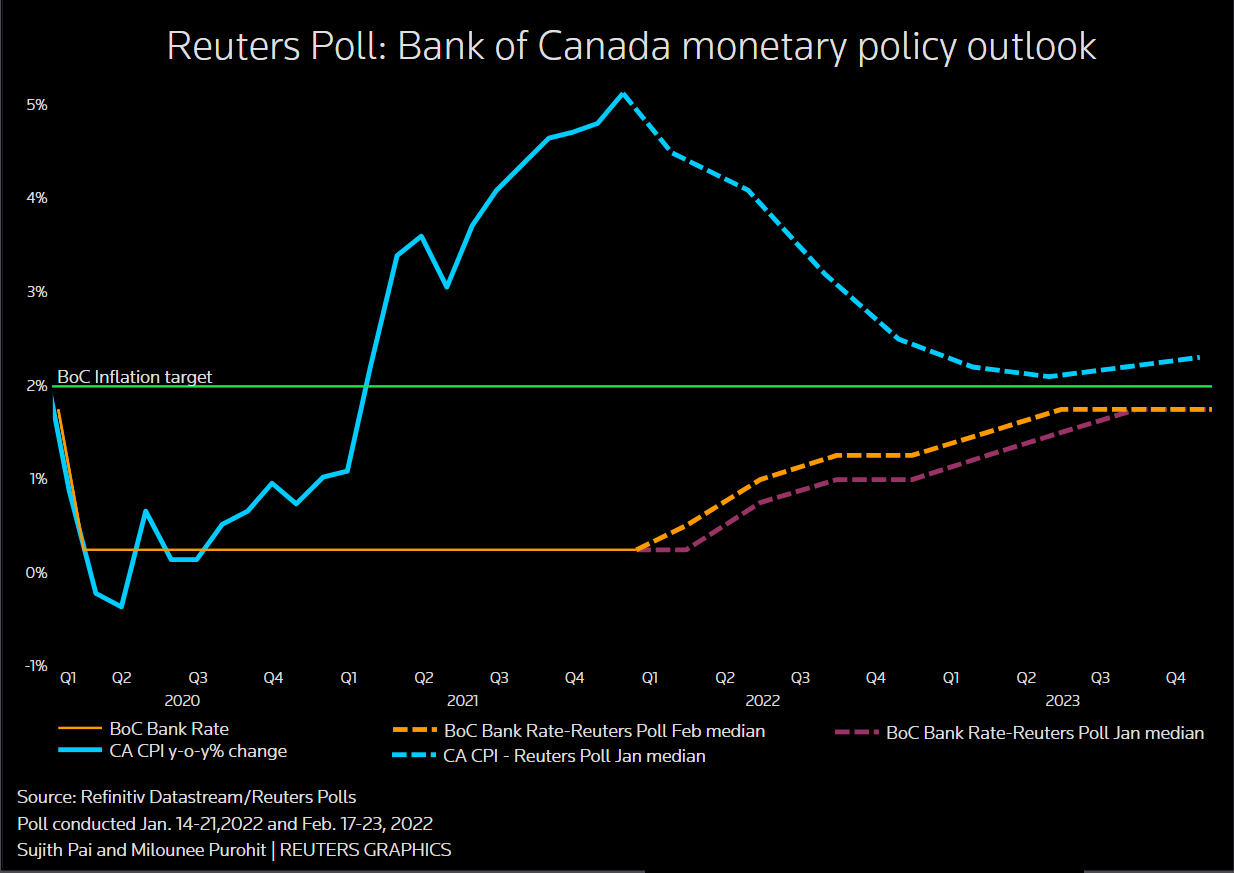

In a report published last week economists Benjamin Tal and Karyne Charbonneau say they expect the Bank of Canada to hike another 75 bps next week and will then call it a day leaving the overnight target rate at 325 for the duration of 2023. The labour market loosened somewhat in August as the Canadian economy lost 40000 jobs. The monthly decline was the third in a row which tends to be indicative of.

Another interest rate hike from the Bank of Canada means some Canadians could be spending a lot more on their monthly mortgage bills. Central bank will stay aggressive on interest rates had some observers speculating that the Bank of Canada hike on Sept. The Bank of Canada is poised to push ahead with at least another 50 basis point interest-rate hike on Oct.

Even as recession worries intensify in Canada the central bank is likely to go ahead with another supersized interest rate hike next week after data showed underlying inflation was stubbornly. 3 minute read October 6 2022 735 PM UTC Last Updated ago Bank of Canadas hawkish message bolsters case for another large rate hike. The global and Canadian economies are evolving broadly in line with the Banks July projection.

There continues to be a consensus that the Bank of Canada will continue hiking rates into October 79 and many think at the December 37 meeting. Bank of Canada raises rate 75 bps and signals more hikes to come. The Bank of Canada today increased its target for the overnight rate to 3¼ with the Bank Rate at 3½ and the deposit rate at 3¼.

The Bank expects Canadas economy to grow by 3½ in 2022 1¾ in 2023 and 2½ in 2024. Growth is expected to slow to about 2 in the third quarter as consumption growth moderates and housing market activity pulls back following unsustainable strength during the pandemic. 035 Bank of Canada raises key interest rate to 325 per cent signals further hike WATCH.

Inflation that drives aggressive Fed tightening and weakens the Canadian dollar is likely to motivate the Bank of Canada to have greater confidence to shoot past four per cent with its policy rate wrote Derek Holt head of capital markets economics on the Bank of Nova Scotias economics team in a Sept. The benchmark rate currently stands at 325 per cent three percentage points higher than the emergency pandemic low that held until March. Article content Hotter US.

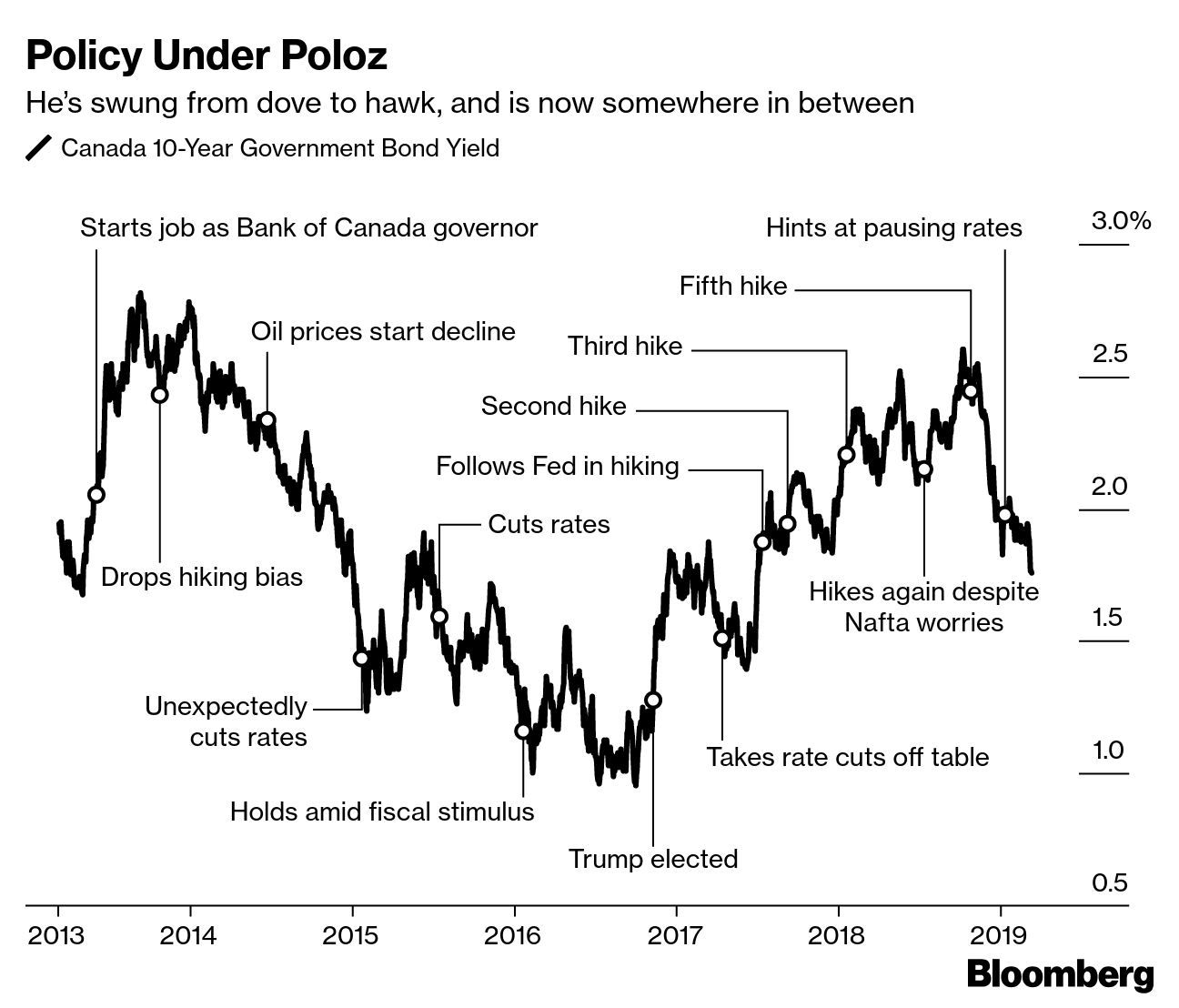

Bank of England errs on the side of caution through latest rate hike. There is generally a consensus amongst economists that more hikes will follow before the end of 2022 but a new report by the Organisation for Economic Co-operation and Development OECD. At the heart of the Bank of Canadas monetary policy is the target for the overnight rate.

Interest rate announcement and Monetary Policy Report. The Bank has repeatedly stated its commitment to raise rates in 2022. The Bank of Canadas aggressive language along with its 75-basis-point boost in the bank rate sends the message that further interest rate hikes are ahead to bring down inflation says Douglas.

The Bank of Canada has raised its key interest rate by three-quarters of a percentage point bringing the central banks target for the overnight rate to 325 per cent. The Bank estimates that GDP grew by about 4 in the second quarter. Bank of Canada delivers 075 percentage point rate hike.

The Bank is also continuing its policy of quantitative tightening. The question now on Canadians minds is when will the cycle of rate hikes come to an end. The most immediate impact will be for variable rate mortgage.

The Bank of Canada is expected to deliver another interest rate increase next Wednesday with forecasters split between a half and three-quarters of a percentage point hike. So far in 2022 the Bank of Canada has hiked the policy interest rate a total of five times with the latest increase in early September pushing the rate up by 075 to from 25 to 325. The hike brings the key interest rate to 325 per cent the highest level since April 2008 when the Bank was slashing its rate in the midst of the Great Recession.

Skys Ian King explains why the bank was clearly split on the path for rates but says there is a clear sign from the meeting. A history of the key interest rate. The Bank of Canada hiked its benchmark interest rate by 75 basis points on Wednesday the fourth consecutive outsized hike and the central bank warned further increases are to come.

Markets are pricing in a 75-bps hike which would bring the Bank of Canadas overnight rate to 325 just above its 2-3 neutral range and into restrictive territory. 7 could even be a full percentage point. His message that the US.

As the Bank of Canada continues to hike rates in order to curb inflation housing prices in Canada could fall 15 per cent from its peak by the end of next year a new report from Desjardins says. See what it isand what it means for you. Interest rate announcement and Monetary Policy Report.

Its a long way above 2 per cent target. The governor of the Bank of England has warned interest rates may need to rise by more than previously expected. If CIBC economists are correct the Bank of Canadas expected rate hike next week will be its last of this rate-hike cycle.

In the current context inflation is not just high. There are signs the economy is slowing. The Bank of Canada raised its overnight interest rate by 75 basis points to 325 per cent on Wednesday its fifth consecutive hike in its.

Bank Of Canada Announces Huge Rate Hike Canadian Mortgage Professional

Bank Of Canada Abandons Rate Hike Bias Amid Economic Slowdown Bnn Bloomberg

Qhof91aglga8im

Bank Of Canada Makes Its Biggest Key Interest Rate Hike In 20 Years Macleans Ca

Rate Hikes When Will They End And What Happens Next

Bank Of Canada Hikes Interest Rates By 75 Basis Points Bnn Bloomberg

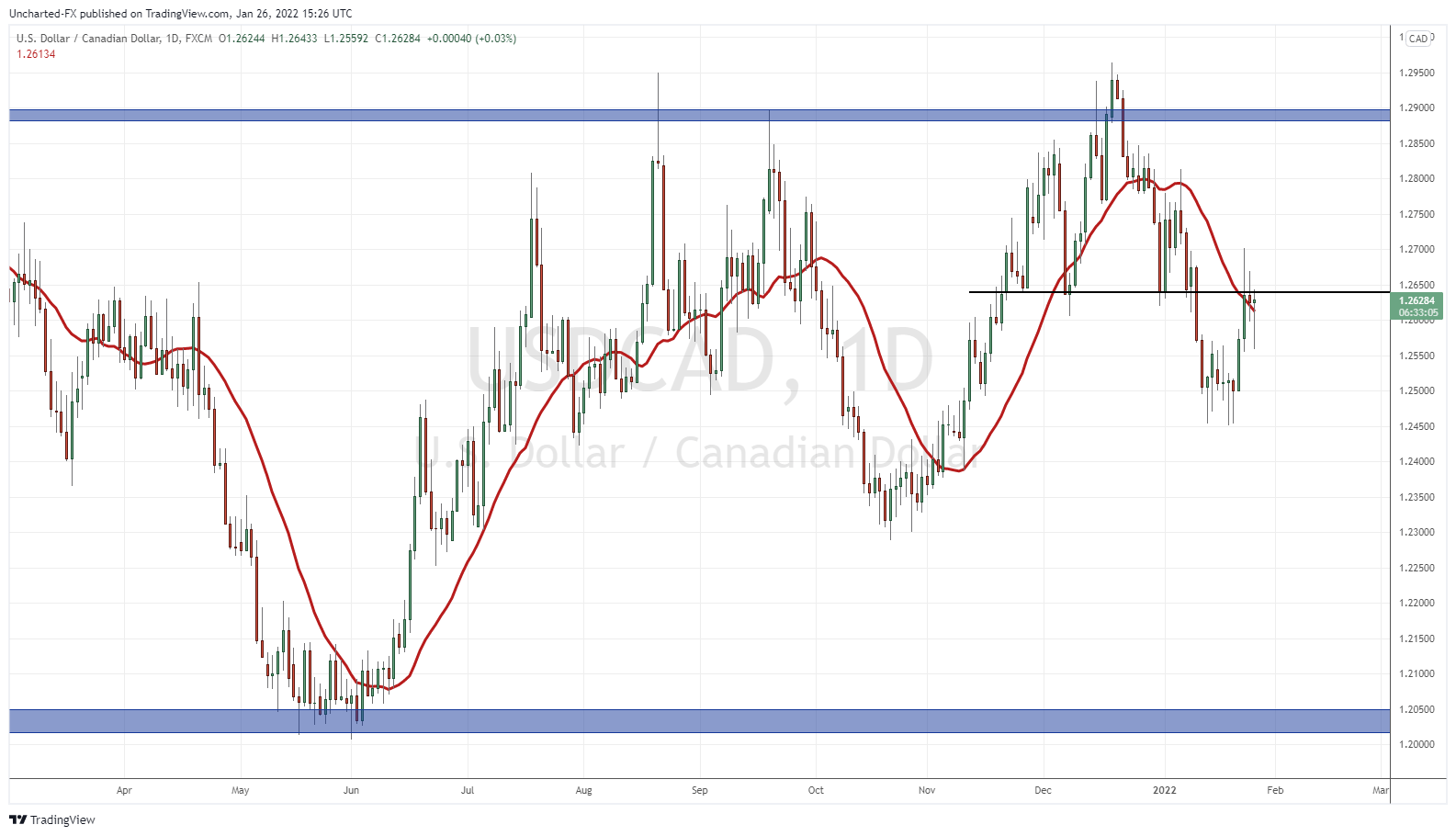

.jpg?width=821&name=CDN%20vs.%20USD%20-%20Chart%20%231%20(2).jpg)

Why The Bank Of Canada Won T Hike Before The Us Fed

Bank Of Canada Interest Rate Hike Are Interest Rates Going Up In Canada

Bank Of Canada March Interest Rate Hike A Done Deal Say Economists Reuters

Bank Of Canada Raises Interest Rate To 1 75 Cbc News

Economists Expect Bank Of Canada To Hike Key Interest Rate By 0 75 On Wednesday Investment Executive

Bank Of Canada Moves Up Rate Hike Forecast Ends Qe Amid Higher Inflation Saltwire

O3erebvsc0idqm

Bank Of Canada Hints At More Aggressive Pace As It Hikes Rates Reuters

Hawkish Bank Of Canada Speech Puts Half Point Rate Hike In Play Bnn Bloomberg

Bank Of Canada Issues A Supersized Rate Hike

Bank Of Canada Interest Rate Hike Likely First Of Many Say Analysts